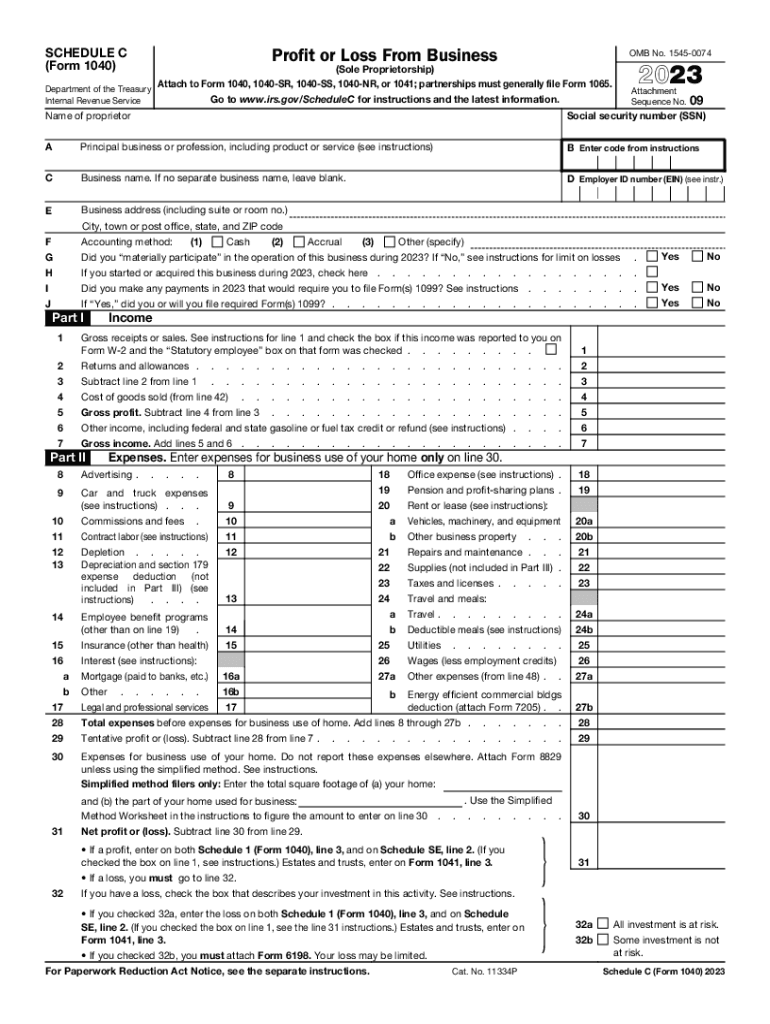

Schedule C Tax Form 2024 – Are there ways to reduce this tax burden? Here’s what you need to know. Schedule C (1040) is an IRS tax form for reporting business-related income and expenses. Its official name is Profit or Loss . In fact, they come together during tax season when small business owners file their Schedule C tax form. This form is used to report income and expenses and ultimately helps to determine whether a .

Schedule C Tax Form 2024

Source : www.kxan.comHow to Fill Out Schedule C Form 1040 for 2023 | Taxes 2024 – Money

Source : content.moneyinstructor.comHow to Fill Out Schedule C Form 1040 for 2023 | Taxes 2024 | Money

Source : www.youtube.com2018 2024 Form IRS 1040 Schedule C EZ Fill Online, Printable

Source : irs-schedule-c-ez.pdffiller.comHow to Fill Out Schedule C Form 1040 for 2023 | Taxes 2024 | Money

Source : www.youtube.comSchedule c tax form: Fill out & sign online | DocHub

Source : www.dochub.comWhere To Find My 2022 Tax Information (2024–25) | Federal Student Aid

Source : studentaid.govWhat Is Schedule C (IRS Form 1040) & Who Has to File? NerdWallet

Source : www.nerdwallet.comWhere To Find My 2022 Tax Information (2024–25) | Federal Student Aid

Source : studentaid.govHow to Fill Out Schedule C Form 1040 for 2023 | Taxes 2024 | Money

Source : www.youtube.comSchedule C Tax Form 2024 Harbor Financial Announces IRS Tax Form 1040 Schedule C : New technology systems and the addition of cryptocurrency on tax forms are just some of the IRS developments to watch in 2024. . The IRS invitation for taxpayers to declare their income from stolen goods and illegal activities has gone viral on social media. .

]]>

.png)